Condo Insurance in and around Glencoe

Condo unitowners of Glencoe, State Farm has you covered.

Cover your home, wisely

Home Is Where Your Condo Is

When looking for the right condo, it's understandable to be focused on details like your future needs and neighborhood, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Condo unitowners of Glencoe, State Farm has you covered.

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

Things do happen. Whether damage from freezing pipes, fire, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unanticipated circumstances. Agent Larry Anderson would love to help you build a policy that is personalized to your needs.

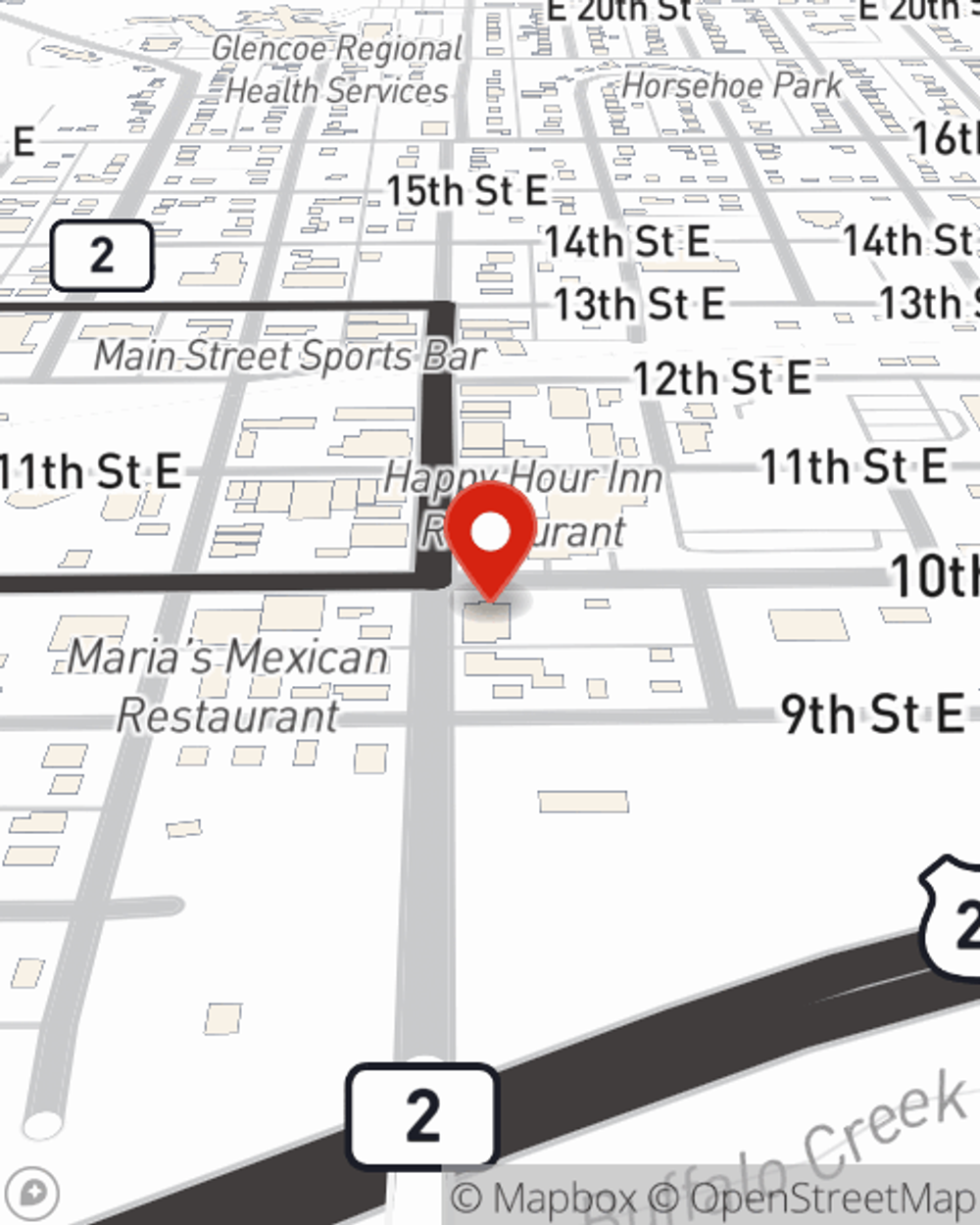

If you're ready to bundle or explore more about State Farm's fantastic condo insurance, visit agent Larry Anderson today!

Have More Questions About Condo Unitowners Insurance?

Call Larry at (320) 864-5515 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Larry Anderson

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.